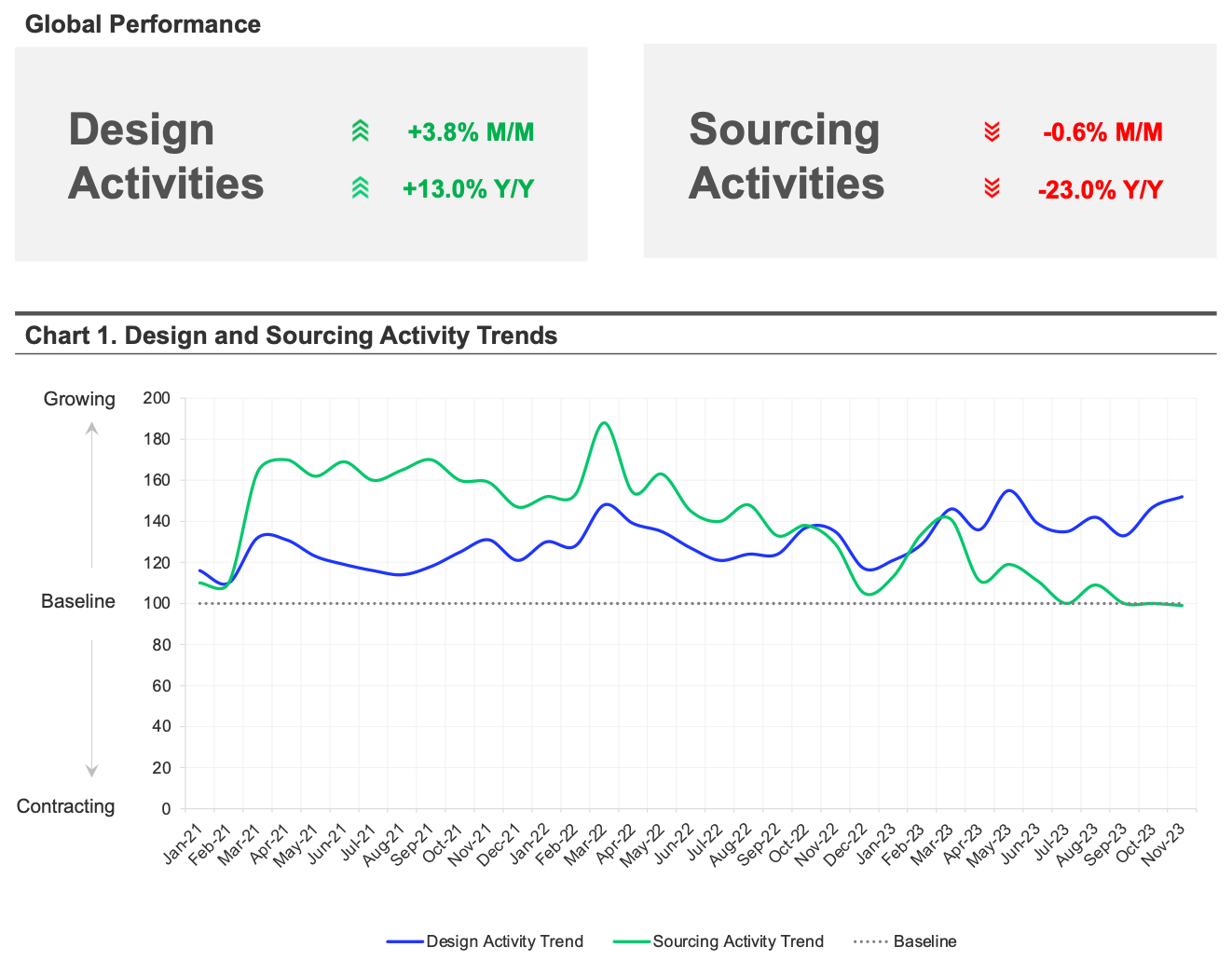

November highlights:

In November, there were no significant changes in design and sourcing activities observed. Similar to the preceding three months, global design activities displayed a positive trend, with continued growth, while global sourcing activities remained flat.

Global design activities experienced a month-over-month increase of +4% and a +13% growth compared to November 2022. This growth was evident across all regions, with the most substantial rise in activities occurring in EMEA (+6%). APAC saw a +2% increase, and the Americas region observed a +1% growth from October. Top product categories in the regions included connectors, capacitors, resistors, transistors, and optoelectronics. Design activities around microcontrollers and processors remained flat month-over-month.

Global sourcing activities maintained their stability for the third consecutive month, staying close to the baseline. Sourcing activities remained below the previous year, with a decline of -23% compared to November 2022. APAC showed growth at +8%, while sourcing activities declined in both the Americas and EMEA compared to October. Top product categories driving demand in these regions included connectors (+29%); power circuits (+11%); capacitors (+17%); resistors (+20%); and memory (+14%).

2023 Year-to-date Summary (January – November):

Throughout the calendar year, global design activities demonstrated a growth of +6%, whereas global sourcing activities decreased by -25% compared to the first eleven months of 2022.

Q4 2023 projections:

The Q4 projections remain unchanged; global design activities are anticipated to grow by +7% quarter-over-quarter as European activities rebound from the summer slowdown. In contrast, global sourcing activities are expected to decrease by -6% quarter-over-quarter, primarily due to reduced activities in the Americas region.