More and more Chinese manufacturers are entering the market of analog chips for signal chains. Leveraging their advantages such as lower prices and proximity to local market, they are eating into the market share of leading overseas manufacturers, especially at the lower end of the market.

As one of a series of articles analyzing signal chain chip manufacturers, this article highlights the difference between leading overseas analog chip manufacturers Analog Devices (ADI) and Texas Instruments (TI) and leading Chinese analog chip manufacturers SGMICRO, 3PEAK and NOVOSENSE in the business footprint as well as the gap between them in financial data and product performance metrics.

Business Footprint

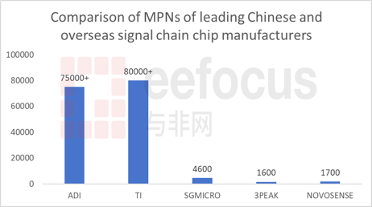

1. The gap is 17-fold in MPNs

Founded in 1965 and 1930 respectively, ADI and TI are the Top 2 analog chip manufacturers in the world. Both companies have a wide range of product lines, including analog chips (e.g. signal chain chips and power management chips), microcontrollers, sensors, etc. Yet they all focus on analog chips. For example, the business of analog chips accounted for 74% of TI’s revenue in 2023.

In contrast, the leading Chinese analog chip manufacturers are basically concentrated on the category of analog chips, with some of them slowly expanding upward or downward to categories such as sensors and microcontrollers.

ADI and TI are far ahead of the competition in MPNs. They have 75,000+ and 80,000+ MPNs respectively, according to their latest data. Each of them has a very broad product portfolio. As of the end of Q2 2023, leading Chinese analog chip manufacturers SGMICRO, NOVOSENSE and 3PEAK have 4,600, 1,700 and 1,600 MPNs respectively. The gap in MPNs between SGMICRO and TI, for example, is over 17-fold.

Source: The websites and financial results of those companies. Produced by eefocus

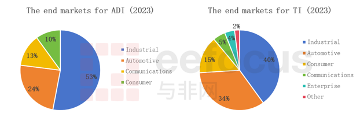

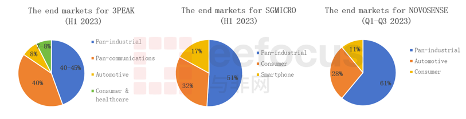

2. Overseas leaders mainly focus on industrial and automotive markets, whereas Chinese companies have a smaller share in the automotive market

Both ADI and TI have a strong presence in industrial and automotive markets. In 2023, the contribution of the industrial business to their revenue was 53% for ADI and 40% for TI, whereas the contribution of the automotive business to their revenue was 24% for ADI and 34% for TI. The contribution of the industrial business and the automotive business combined to their revenue in 2023 was around 75% for both ADI and TI.

Source: The financial results of those companies. Produced by eefocus

The Chinese companies and the overseas leaders were similar to each other in terms of their revenue from the industrial business as a percentage of their total revenue. The revenue from the industrial business as a percentage of their total revenue was 40-45% for 3PEAK, 51% for SGMICRO and 61% for NOVOSENSE. The revenue from the industrial business was around half of their total revenue for all the three Chinese companies, similar to the two overseas leaders.

The revenue of the three Chinese companies from higher-end automotive-grade products as a percentage of their total revenue was far lower in comparison with the two overseas leaders. The revenue of 3PEAK from the automotive business as a percentage of its total revenue in H1 2023 was only 8%, whereas SGMICRO almost had no revenue from the automotive business during the same period. Currently, both companies have around 100 MPNs for automotive-grade chips, which is a relatively small number.

Source: The financial results of those companies. Produced by eefocus

It’s worth mentioning that, in the first three quarters of 2023, the automotive business accounted for 28% of NOVOSENSE’s revenue. The company was ahead of most other Chinese companies in terms of its revenue from the automotive business either absolutely or proportionally. Back in 2016, NOVOSENSE already began to launch the signal conditioning ASICs for pressure sensors targeting automotive OEMs. Today, the company’s automotive-grade chips have successfully penetrated into China’s mainstream automotive supply chain and achieved mass adoption in OEMs such as BYD, Dongfeng Motor, Wuling Motors, GWM, SAIC Maxus, FAW Group, CATL, and Yunnei Power. They have also entered the supply chain of companies like SAIC Volkswagen, UAES, and Sensata.

3. The revenue from the U.S., Europe and China contributes to nearly 80% of the total revenue of the two overseas leaders, whereas the Chinese companies basically focus on China’s domestic market

In addition, ADI and TI as global semiconductor companies are doing business across the globe. The U.S., Europe and China are their biggest markets, together accounting for about 80% of their revenue.

The revenue of ADI by region is very similar to that of TI. The revenue of ADI in the U.S., Europe, China, Japan, and Asia (excluding China/Japan) was respectively 34%, 25%, 18%, 11% and 11% of its total revenue in 2023. In comparison, the revenue of TI in the U.S., EMEA (Europe, Middle East and Africa), China, Japan, and Asia (excluding China/Japan) was respectively 33%, 26%, 19%, 10% and 10% of its total revenue in 2023.

Source: The financial results of those companies. Produced by eefocus

In contrast, the business of the Chinese companies is concentrated in China. For example, the revenue of SGMICRO from overseas sources only accounted for 3.7% of its total revenue in 2022.

The comparisons made above depict a clear path for the future growth of the Chinese analog chip manufacturers: 1) to diversify products and expand categories; 2) to develop markets at the higher end; and 3) to seek globalization.

Financial Data

1. The Chinese chip manufacturers are eating into the market share of the two overseas leaders

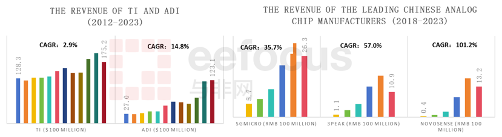

The compound annual growth rate (CAGR) of the revenue of TI and ADI during 2012-2023 was 2.9% and 14.8% respectively.

The revenue growth of TI was surprisingly slow during the ten-year period. That’s because TI had already announced its exit from the market for smartphone processors in September 2012, and its revenue during that period was very much indicative of the performance of its analog chip business: its CAGR was much lower than that of the global analog chip market (close to 6.5%) during the same period.

Source: Wind. Produced by eefocus

Let’s now look at ADI. The CAGR of its revenue during 2012-2023 was 14.8%, which seemed not low, but was largely driven by the company’s three major acquisitions:

- In 2014, ADI acquired Hittite Microwave Corporation, a designer and manufacturer of integrated circuits (ICs), modules and instrumentation for RF, microwave and millimeterwave applications, for $2.45 billion in cash.

- In March 2017, ADI completed the acquisition of Liner Technology Corporation for $14.8 billion. Liner was the second-largest manufacturer of power chips and the eighth-largest manufacturer of analog chips in the world at that time, whereas ADI was relatively weak in power chips. The product lines of the two companies were highly complementary with each other.

- In 2021, ADI acquired Maxim for $20.9 billion in an all-stock transaction with ADI stockholders owning approximately 69% of the combined company upon closing. The businesses of the two companies were similar to each other in several aspects, so the merger would enable them to be better positioned to compete with the industry leader TI.

At a rough estimate, excluding the three acquisitions above, the CAGR of the existing business of ADI should be slightly higher than that of the global analog chip market during the same period.

In contrast, the CAGR was 35.7%, 57.0% and 101.2% for SGMICRO, 3PEAK and NOVOSENSE respectively during 2018-2023, far higher than that of the two overseas leaders. They were eating into their share in the Chinese market. They had a higher CAGR simply because of a lower baseline, a higher localization rate caused by the sanctions against Chinese chip manufactures, the upward cycle of the semiconductor industry, etc.

Despite the lackluster performance of leading overseas analog chip manufacturers for years in the past, automotive electronics as one of the main downstream battlefields for analog chips will enable the entire analog chip market to have a lasting growth thanks to the growing penetration of NEVs globally. The competition among Chinese analog chip manufacturers is just getting started.

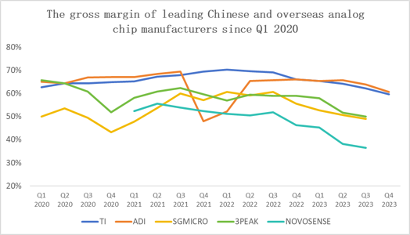

2. The gross margin is 10% lower for the Chinese chip manufacturers

Since 2020, the gross margin of ADI and TI basically has been over 60%, and has been relatively stable, whereas the gross margin of the Chinese companies has been fluctuating significantly. The gross margin of 3PEAK fell from 65.7% in Q1 2020 to 50% in Q3 2023, and that of NOVOSENSE fell from 52.3% in Q1 2021 to 36.5% in Q3 2023.

It’s worth mentioning that the gross margin of SGMICRO was 50% in Q1 2020 and 49% in Q3 2023, which was relatively stable. This was mainly attributable to the growing percentage of the company’s signal chain business, which had a higher gross margin, during that period.

The gross margin of the two leading overseas analog chip manufacturers was generally higher than that of the three Chinese companies. That was quite understandable: the two overseas analog chip manufacturers are the Integrated Device Manufacturers (IDMs) and have a higher percentage of higher-end products. Especially, as they are using 12-inch wafers to produce analog chips, the costs of their products are further reduced.

Source: Wind. Produced by eefocus

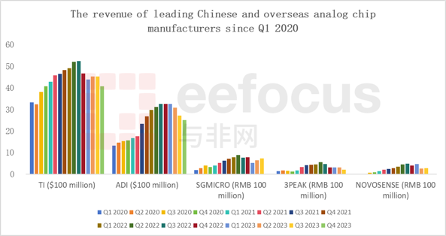

3. Inventory more than doubled from two years ago

In this downward cycle of the semiconductor industry, the growth of the quarterly revenue already began to slow down significantly in H2 2022 for all analog chip manufacturers, with the slowdown beginning earlier for some and later for others.

Source: Wind. Produced by eefocus

The inventory strategy varied significantly from one chip manufacturer to another:

The inventory value of ADI began to go down in Q3 2023, one quarter later than revenue.

Instead of going down, the inventory value of TI was going up from $1.86 billion in Q3 2021 to $4 billion in Q4 2023. Its Days Sales of Inventory (DSI) in Q4 2023 increased 14 days sequentially to 219 days. TI said that it already reduced its factory utilization rate in Q4 2023, which is expected to be further adjusted in Q1 2024, but its inventory level may continue to rise in Q1 2024.

The inventory value of SGMICRO went down slightly in Q3 2023. The inventory value of 3PEAK and NOVOSENSE was still going up in the latest quarter.

Source: Wind Source: Wind

ADI—inventory TI—inventory

We calculated the inventory value of the five companies mentioned above in Q2 2021 and Q4 2023. Because the Chinese companies haven’t announced their financial results for 2023 yet, their Q3 2023 data was used. The result is that their combined inventory value was $2.6 billion in Q2 2021 and $5.9 billion in Q4 2023.

The overall inventory value of the industry is estimated to be more than doubled from two years ago. Although analog chips are characterized by long lifecycles and low depreciation risks, under the pressure of an enormous inventory, the competition will be extremely intense in a very long time to come, preventing the prices of analog chips from going up.

Product Performance Metrics

As mentioned above, the three Chinese analog chip manufacturers have a gap of more than 17-fold from ADI and TI in terms of MPNs, showing a very big gap between Chinese and overseas analog chip manufacturers when it comes to product variety in each category.

So how big is the gap in the performance metrics of specific products? Next, we will compare different companies for their products in three categories of signal chain chips (op amps, data converters, and isolators & interfaces) by selecting models with the best performance metrics shown on the website of each company.

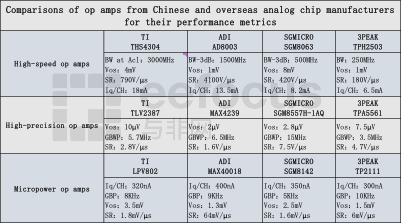

1. Op amps: Overseas leaders are relatively ahead

For op amps, we have selected three sub-categories to make comparisons: high-speed op amps, high-precision op amps, and micropower op amps. NOVOSENSE is not included in our comparisons, because its products in this category are mainly signal conditioning ASICs.

Source: The websites of those companies. Produced by eefocus

- High-speed op amps: The bandwidth of TI’s THS4304 (BW @ Acl) is 3,000 MHz, and the bandwidth of ADI’s AD8003 (BW @-3dB) is 1,500 MHz. They are far ahead of the corresponding products from SGMICRO and 3PEAK. The bandwidth of SGMICRO’s SGM8063 is significantly bigger than that of 3PEAK’s TPH2503.

- High-precision op amps: The input offset voltage (VOS) of ADI’s MAX4239 is 2 μV, which is better than that of other manufacturers. It’s worth mentioning that the VOS of SGMICRO’s SGM8557H-1AQ is 2.8 μV, which is very close to that of MAX4239, and its Gain Bandwidth Product (GBWP) and Slew Rate (SR) are better than those of MAX4239.

- Micropower op amps: The quiescent current of the micropower op amps from these manufacturers is relatively close to each other. The quiescent current of 3PEAK’s TP2111 as shown on its website is 300 nA, which is the best, and this product is also relatively better in terms of other key metrics.

For op amps in the three sub-categories above, ADI and TI are far ahead of the competition in high-speed op amps, but there isn’t a clear gap between the Chinese companies and them in performance metrics for products of the other two sub-categories: high-precision op amps and micropower op amps.

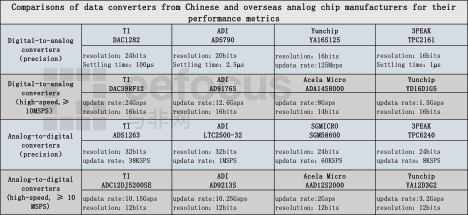

2. Data converters: Overseas leaders are absolutely ahead

For data converters, we have selected four sub-categories to make comparisons (resolution limit: ≥ 12 bits): digital-to-analog converters (precision), digital-to-analog converters (high-speed), analog-to-digital converters (precision), and analog-to-digital converters (high-speed). As local manufacturers Acela Micro and Yunchip focus on making high-speed data converters, they are included in our comparisons. NOVOSENSE is not included in our comparisons, because its products in this category are mainly signal conditioning ASICs.

| Comparisons of data converters from Chinese and overseas analog chip manufacturers for their performance metrics | ||||

| Digital-to-analog converters (precision) | TI 24 bits | ADI 20 bits | Yunchip 16 bits | 3PEAK 16 bits |

| Digital-to-analog converters (high-speed, ≥ 10 MSPS) | TI 16 bits | ADI 16 bits | Acela Micro 14 bits | Yunchip 16 bits |

| Analog-to-digital converters (precision) | TI 32 bits | ADI 32 bits | SGMICRO 24 bits | 3PEAK 24 bits |

| Analog-to-digital converters (high-speed, ≥ 10 MSPS) | TI 12 bits | ADI 12 bits | Acela Micro 12 bits | Yunchip 12 bits |

Source: The websites of those companies. Produced by eefocus

- Digital-to-analog converters (precision): The resolution of TI’s DAC1282 (24 bits) and ADI’s AD5790 (20 bits) is significantly higher than that of the corresponding products from local manufacturers. However, it’s worth mentioning that Yunchip’s YA16S125 has a sampling rate of 125 MSPS despite its resolution of 16 bits, which is obviously better than that of 3PEAK’s TPC2161 (settling time: 1μs).

- Digital-to-analog converters (high-speed): With the same resolution of 16 bits, the sampling rate of TI’s DAC39RF12 (24 GSPS) and ADI’s AD9176S (12.6 GSPS) is significantly higher than that of the corresponding product of Yunchip.

- Analog-to-digital converters (precision): TI’s ADS1263 has a resolution of 32 bits, and ADI’s LTC2500-32 has a resolution of 32 bits and a sampling rate of 1 MSPS, significantly higher than that of the corresponding products from local manufacturers.

- Analog-to-digital converters (high-speed): With the same resolution of 12 bits, the sampling rate of TI’s ADC12DJ5200SE (10.15 GSPS) and ADI’s AD9213S (10.25 GSPS) is significantly higher than that of the corresponding products from local manufacturers.

When it comes to the core performance metrics of data converters, ADI and TI are absolutely ahead of local manufacturers. Such products of Yunchip, 3PEAK, Acela Micro and SGMICRO are better than those from other local manufacturers.

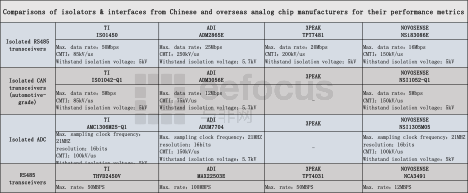

3. Isolators & interfaces: Overseas leaders are not clearly ahead

For isolators & interfaces, we have selected four sub-categories for comparisons: isolated RS485 transceivers, isolated CAN transceivers (automotive-grade), isolated ADC, and RS485 transceivers. SGMICRO is not included in our comparisons, because it has few such products.

| Comparisons of isolators & interfaces from Chinese and overseas analog chip manufacturers for their performance metrics | ||||

| Isolated RS485 transceivers | TI Max. data rate: 50 Mbps CMTI: 85 kV/µs Withstand isolation voltage: 5 kV | ADI Max. data rate: 25 Mbps CMTI: 250 kV/µs Withstand isolation voltage: 5.7 kV | 3PEAK Max. data rate: 20 Mbps CMTI: 200 kV/µs Withstand isolation voltage: 5 kV | NOVOSENSE Max. data rate: 16 Mbps CMTI: 150 kV/µs Withstand isolation voltage: 5 kV |

| Isolated CAN transceivers (automotive-grade) | TI Max. data rate: 5 Mbps CMTI: 85 kV/µs Withstand isolation voltage: 5 kV | ADI Max. data rate: 12 Mbps CMTI: 75 kV/µs Withstand isolation voltage: 5.7 kV | 3PEAK — | NOVOSENSE Max. data rate: 5 Mbps CMTI: 150 kV/µs Withstand isolation voltage: 5 kV |

| Isolated ADC | TI Max. sampling clock frequency: 21 MHz Resolution: 16 bits CMTI: 100 kV/µs Withstand isolation voltage: 5 kV | ADI Max. sampling clock frequency: 21 MHz Resolution: 16 bits CMTI: 150 kV/µs Withstand isolation voltage: 5.7 kV | 3PEAK — | NOVOSENSE Max. sampling clock frequency: 21 MHz Resolution: 16 bits CMTI: 100 kV/µs Withstand isolation voltage: 5 kV |

| RS485 transceivers | TI Max. rate: 50 MBPS | ADI Max. rate: 100 MBPS | 3PEAK Max. rate: 50 MBPS | NOVOSENSE Max. rate: 12 MBPS |

Source: The websites of those companies. Produced by eefocus

- Isolated RS485 transceivers: ADI’s ADM2865E performs slightly better than 3PEAK’s TPT7481 in terms of the max. data rate, CMTI and withstand isolation voltage, but without a clear leading edge.

- Isolated CAN transceivers (automotive-grade): NOVOSENSE’s NSI1052-Q1 performs better than TI’s ISO1042-Q1 in terms of the max. data rate, CMTI and withstand isolation voltage, and performs slightly worse than ADI’s ADM3056E in terms of max. data rate and withstand isolation voltage.

- Isolated ADC: NOVOSENSE’s NSI1305M05 is comparable to the corresponding products from the two overseas leaders in terms of the max. sampling clock frequency, resolution, CMTI and withstand isolation voltage.

- RS485 transceivers: The max. rate of 3PEAK’s TPT4031 (50 MBPS) is the same as that of TI’s THVD3450V, but smaller than that of ADI’s MAX22503E (100 MBPS).

We can see that the leading Chinese companies don’t have a clear gap with ADI or TI when it comes to the key performance metrics of isolators and interfaces.

Last Word

It’s worth pointing out that the Chinese manufacturers are growing very fast, are trying to develop more higher-end products such as automotive-grade chips, and are even on a par with ADI or TI when it comes to the performance metrics of products in some signal chain categories.

The Chinese manufacturers of analog chips for signal chains are behind the overseas leaders in terms of product variety, higher-end products, global operations or profitability. They are just getting started to move towards the higher end of the value chain.